As a business dipping your toes into the world of white labeling or other crypto startup, you must sign a contract with a cryptocurrency market maker as soon as you’ve developed your product. – You may think that branding and advertising will do the rest, nevertheless, there is additionally liquidity that, with out exaggeration, determines how useful your trade is for the traders. HashCash Consultants is a world software program firm that focuses on creating technological functions for Blockchain, AI, Big Data, and IoT companies. The administration team is one other aggressive benefit AlphaPoint has over its rivals. The company has stormed into the cryptocurrency trade already having a robust background in traditional finance. Scott Bambacigno, Igor Telyatnikov, Joe Ventura and Jack Sallen are a variety of the founder members of AlphaPoint.

- Our Cryptocurrency Exchange Software offers a full suite of superior tools that allow users and traders.

- HollaEx is the fastest approach to get your crypto change up and buying and selling in minutes.

- However, with white label merchandise, you only get to personalize a few of their options and design.

- Servicing Canada, Bitvo is a cutting-edge cryptocurrency trade that facilitates buying, promoting and trading cryptocurrencies through its web site and mobile applications.

How Lengthy Does It Take To Launch A White-label Crypto Exchange?

• Support multiple cost modes, together with fiat currencies and crypto funds. B2Broker’s answer is right for businesses seeking a quick and secure setup with high white label bitcoin exchange software scalability potential. This crypto-to-crypto conversion solution allows business owners to conduct operations in either fiat or cryptocurrency mode. Significant time is saved when creating and offering white label trade programming to the shopper. We utilize the most superior and effective tech stack for designing and growing Cryptocurrency change software. Build a safe, scalable, and feature-rich crypto change with our Best White Label Cryptocurrency Exchange Software.

Did you realize that in 2021 that folks looked for bitcoin 7X more than for the greenback and 42X times greater than for EURO? Also, did you know the word “bitcoin” seems every 3 seconds on social media? This volume suggests that individuals are changing into highly conversant in digital currencies and that slow mass adoption is silently brewing.

Common Safety Audits

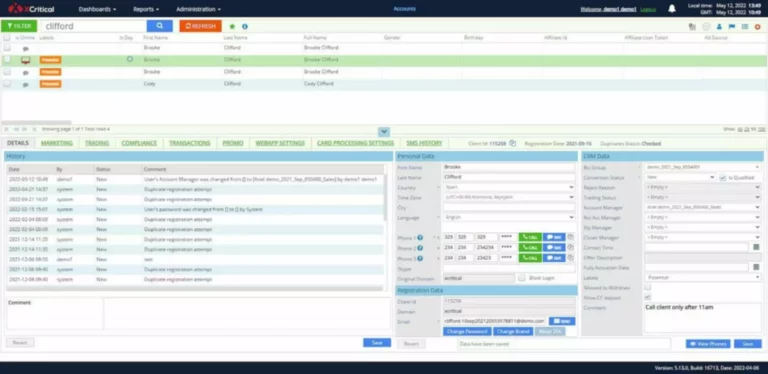

🌟Compliance — Meeting regulatory requirements is mandatory for working a authorized and trustworthy exchange. Choose a platform with built-in KYC (Know Your Customer) and AML (Anti-Money Laundering) options to confirm person identities and stop fraud. To develop an unique bundle that carries net along with the cell application will value around $10,000 – $1,50,000.

Service-based matching know-how It is an exchange-grade, configurable platform for matching provide and demand on a broad variety of asset courses, from restricted edition fashion goods to prediction markets. It is possible to retailer a significant number of cryptocurrencies which might be traded on the Merkeleon change platform utilizing the wallet service supplied by the trade. The platform’s strong risk administration instruments and secure wallets appeal to each users and buyers. The built-in cryptocurrency storage solution permits your users to retailer, obtain, and switch any cryptocurrency assets seamlessly and without problem.

Most crypto change themes will not permit the client to attempt earlier than they purchase, but will rather, showcase a static demo that isn’t trading any actual cash. If this is the case then ask for a working live demo with real-life trades. Normally, it would take a typical startup nicely over a year to create a crypto change with all the components above, costing companies tons of of 1000’s of dollars in developer charges. Digital identity, sovereign knowledge Cryptocurrency wallet management, gaming, on-chain possession, international trade, real world property, artificial collateralization and – in fact – fiat emulation. Indeed, and paradoxically, stablecoins which are pegged to fiat currencies are one of crypto’s most staggeringly effective use-cases so far.

Enable customers to earn after they refer their good friend to create an account within the platform. This has turn out to be more well-liked among the customers as they can earn an additional revenue along with trading cryptocurrencies. Depositing fiat currencies or connecting crypto wallets could be carried out here to buy or sell cryptocurrencies. Withdrawals and deposits may be carried out easily from the platform and receive affirmation messages Instantly. AlphaPoint helped prepare us with white label expertise for the era of digital transformation, where adoption of revolutionary finance software program ought to be easy, intuitive and socially inclusive. We’re generating financial wellness for a greater number of individuals and serving to them to take part within the international economic system.

HollaEx is probably the most user-friendly and fastest-to-market white label cryptocurrency change when it comes to ease of use and pace to market. Consequently, the platform may be very configurable, enabling you to add currencies on the fly and even rename them via direct trade modification instruments. Kraken crypto exchange stands out for its exceptional security and regulatory compliance. Using its White Label answer might be best for businesses that prioritize these features. Launched in 2011, Kraken presents a holistic vary of superior buying and selling tools, including margin buying and selling and futures contracts.

Try our simulated demo setup and experience simply how easy is to launch your own crypto exchange with HollaEx®. The scalability of any cryptocurrency platform is characterized by its capability to adapt to customer preferences, which is facilitated by our user-friendly interface. As the main White-Label Cryptocurrency Exchange supplier within the cryptocurrency industry, so far we’ve efficiently delivered greater than 200+ projects to our worldwide clients.

It allows customers to trade every kind of cryptocurrencies whereas making certain trust, transparency, and security. White-label crypto exchange software program supplies a ready-made resolution for launching your crypto exchange rapidly and cost-effectively. It consists of pre-built options like trading engines, liquidity options, and safety protocols, saving you time on development. You can customise the platform to match your branding, integrate cost gateways, and give consideration to attracting users as an alternative of constructing everything https://www.xcritical.com/ from scratch.

The platform options essential risk administration tools, including stop-loss and take-profit orders. In 2024, Bybit achieved over $7 billion in day by day buying and selling quantity, highlighting its in depth international attain and strong market presence. For startups trying to enter this trade, deploying a bug-free Bybit clone at an inexpensive value offers an excellent alternative for you. Remitano crypto trade is extremely regarded for its effort-free peer-to-peer (P2P) trading capabilities.

Decentralized exchanges allow peer-to-peer transactions with out a government, reducing the danger of hacks and fraudulent activities. From this article, you’ll learn about the most effective AI shares to spend cash on to get the maximum revenue. Size and strength You can simply upgrade when your traffic increases and also you need more pace. In order to maintain up with the company’s fast progress, Exberry’s technology is exchange-grade and enables low latency and high volume throughput. Traders will get essentially the most from a user-friendly interface that’s particularly tailored to their wants.

.jpeg)

.jpeg)

.jpeg)